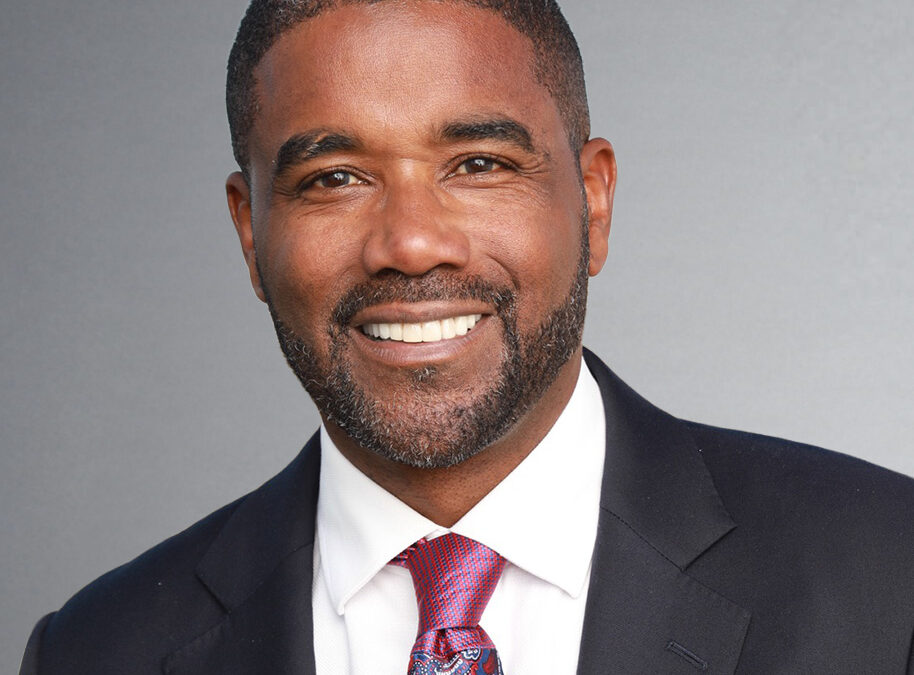

Renee Finch

Renee Finch

BAR ADMISSIONS

Nevada

Colorado

United States District Court, District of Nevada

Ninth Circuit Court of Appeals

Education

University of Nevada

– Juris Doctorate

South Dakota State University

– B.A. English

Bio

Renee Finch

Renee Finch is one of the most highly respected trial attorneys in Las Vegas, Nevada. Her track-record of obtaining amazing results for her clients actually started by defending, during the first several years of her career, major insurance companies and nationally-known corporations. As a result of this representation, she gained a thorough understanding of the extent to which such entities will go to protect their bottom line, the degree to which they will attempt to obtain unfair advantages and, most importantly, the lack of respect and dignity they have for the individuals who often are injured by their actions and decisions made solely in furtherance of profit.

Renee was born in Alliance, Nebraska and had a solid midwestern upbringing in the Great Plains states of Nebraska and South Dakota. While still in high school, she began working as a law clerk at a Rapid City, South Dakota law firm. It was there that she first learned the importance of the patient and careful examination of the law and how that, combined with a focus on empathy, attention to detail, and appropriate aggression, is crucial to obtaining justice. She moved to Nevada after graduating from South Dakota State University, where she had won the NCAA national debate championship, and began law school. After learning during her early legal career the hard lessons of how the corporate “profits over people” mentality is devastating to individuals, she dedicated her career to obtaining justice for those injured by the actions of companies and entities that operate with little to no regard for the rights of others.

Through her dedication to upholding the rights of those injured by others, Renee obtained one of the largest settlements in Las Vegas product liability litigation history after a company’s negligence and intentional disregard of the dangers its own internal testing revealed, resulted in the near- amputation of her client’s hand. Renee has a wealth of experience in cases involving catastrophic injury, wrongful death, and insurance company bad-faith, and is eager to apply that experience to achieve results that better her clients’ and their families’ lives and right the wrongs done to them.

In 2025, she proudly founded Summit Trial Attorneys to achieve for injured individuals and their families the justice and compensation they deserve. She has received multiple awards for being one of Las Vegas’s finest attorneys and is an active member of ABOTA, the American Board of Trial Attorneys. ABOTA is a peer-voted organization that recognizes only the top trial talents in the country.

Renee is married, with four children, Kendall, Cassandra, Kallista and Ethan, and two French bulldogs, Coco and Lulu. In the little spare time she has, she runs a high-end designer handbag and fashion website and participates in local charitable work.